Table of Contents

ToggleAbstract

This article explores how the global aging population is reshaping the automotive industry, particularly the growing demand for steering aids—ergonomic devices such as spinner knobs and steering handles that enhance comfort, safety, and control for senior drivers. As nations like Japan, Germany, the U.S., and South Korea experience rapid demographic shifts, automotive stakeholders—from OEMs to fleet managers—are responding to the mobility needs of older drivers by integrating adaptive technologies into vehicles.

Through market data, regional analysis, and B2B procurement insights, the article highlights how steering aids are evolving from aftermarket accessories into essential components of inclusive vehicle design. It outlines key trends in procurement patterns, OEM integration, and retail strategy, while also addressing challenges around regulation, product quality, and market saturation.

With forward-looking analysis on smart steering aids, haptic feedback, and AI integration, this article serves as a strategic guide for B2B buyers, mobility solution providers, and automotive innovators looking to align their product strategies with a rapidly aging and mobility-conscious global market.

Introduction

The global aging trend is no longer a distant forecast—it is a present-day reality transforming industries, particularly the automotive sector. In countries like Japan, Germany, the United States, and South Korea, the proportion of citizens aged 65 and older is climbing at record speed. By 2030, one in six people globally will be over the age of 60, creating sweeping demand for age-friendly mobility solutions.

This demographic megatrend is pushing automotive manufacturers and parts suppliers to rethink how vehicles are designed, equipped, and marketed. As more elderly individuals continue to drive later in life, ensuring comfort, safety, and control becomes essential—not only for private consumers, but also for public service vehicles, delivery fleets, and commercial operators employing older drivers.

One solution rising to prominence is the steering aid—specifically, steering wheel knobs and spinner handles engineered to reduce strain and improve maneuverability. Once considered niche accessories, these devices are now being reevaluated as vital ergonomic tools that enable senior drivers to maintain independence while enhancing road safety.

For B2B buyers, OEM product planners, and mobility solution providers, this trend presents both a responsibility and a growth opportunity. The demand for high-quality, regulation-compliant steering aids is increasing across markets. From eldercare fleets to adaptive mobility startups, businesses are actively sourcing steering control products that meet the ergonomic needs of older drivers.

This article examines how the aging population is reshaping steering aid demand, explores emerging trends in the B2B procurement landscape, and outlines strategic recommendations for automotive stakeholders looking to stay ahead in a rapidly evolving market.

Global Demographic Shifts Driving Product Demand

Aging Nations: The Silver Surge Is Here

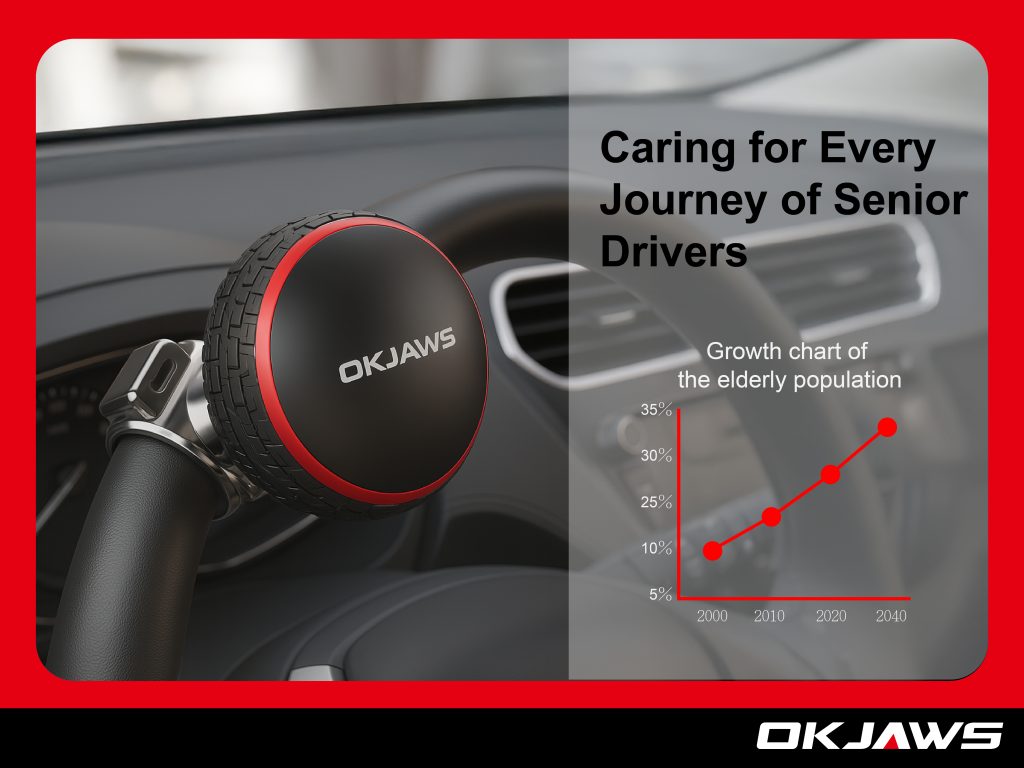

The aging of the global population is accelerating—especially in developed economies where birth rates have declined and life expectancy has increased. According to the World Health Organization (WHO), the number of people aged 60 years and older will rise from 1.4 billion in 2023 to 2.1 billion by 2050. This demographic transformation is most pronounced in key automotive markets:

- Japan leads the world with over 29% of its population aged 65 and above, a figure expected to surpass 35% by 2040 (UN World Population Prospects, 2022).

- Germany and Italy are close behind, with over 22% of their populations already classified as elderly.

- In the United States, the U.S. Census Bureau projects that by 2034, older adults will outnumber children for the first time in history.

- South Korea, once a younger society, now faces the fastest aging curve in the OECD. By 2025, more than 20% of its population will be over 65.

These figures are not abstract statistics—they signal an urgent shift in consumer needs, public policy, and vehicle design. As these nations age, the demand for automotive solutions that cater to reduced physical strength, joint mobility, and reaction time is growing in parallel.

Implications for Vehicle Use: Driving Into Later Life

This global gray wave is altering how vehicles are used, who drives them, and what features are considered essential.

- Senior Drivers Are Staying Behind the Wheel Longer

In Japan, over 3 million licensed drivers are aged 75 or older (Japan National Police Agency, 2023). In the U.S., the Federal Highway Administration reports that the number of drivers aged 70+ increased by 34% over the last decade, now accounting for more than 31 million drivers. Retaining the ability to drive is closely tied to independence, especially in suburban or rural areas with limited public transport. - Functional Decline Spurs Demand for Ergonomic Tools

As aging impacts strength, coordination, and flexibility, older drivers are more likely to struggle with steering control, particularly during tight maneuvers or prolonged trips. This has led to a noticeable uptick in demand for adaptive equipment, particularly steering wheel aids that reduce wrist fatigue, enhance grip, and allow for safer one-handed driving when necessary. - Policy Encouragement for Safer Mobility

Governments and insurance firms in countries like Germany and South Korea are offering incentives or educational programs to support older driver safety—many of which recommend the installation of assistive steering tools as part of broader vehicle adaptation strategies.

For automotive manufacturers, suppliers, and aftermarket distributors, the takeaway is clear: aging is not just a demographic event—it’s a design and sourcing imperative. Steering aids are no longer auxiliary add-ons; they are becoming core components of age-friendly vehicle ecosystems.

What Are Steering Aids and Why Are They Gaining Traction?

Definition & Types: Enhancing Vehicle Control Through Assistive Technology

Steering aids—also known as steering control devices—are tools designed to make steering easier, more stable, and less physically demanding. While initially popular among commercial drivers for maneuverability in tight spaces, these products have evolved to meet the specific needs of elderly and physically limited drivers. The most commonly adopted types include:

- Spinner Knobs:

Also referred to as “steering wheel knobs,” these are mounted on the steering wheel to allow one-handed operation and rapid turning, especially useful for drivers with reduced grip strength or limited shoulder movement. - Ergonomic Support Handles:

Designed with contoured grips, these handles help distribute hand pressure evenly, reducing fatigue over long periods of driving. - Power Assist Steering Tools:

These are more advanced systems—often electronic or hydraulic—that reduce the amount of physical effort required to turn the wheel, increasingly integrated into modern vehicles but also available as aftermarket solutions.

These devices can be either factory-installed by OEMs or added post-sale through certified aftermarket suppliers and distributors.

Core Benefits for Elderly Drivers: Comfort, Confidence, and Safety

As aging drivers face diminished flexibility, arthritis, or reduced upper body strength, steering becomes one of the most physically taxing aspects of driving. Steering aids offer direct, measurable benefits:

- Reduced Wrist and Shoulder Strain:

Spinner knobs and similar devices eliminate the need for repeated full-arm motion, making it easier for elderly drivers to handle the wheel with minimal exertion. - Improved Turning Control:

Devices offer better precision in tight corners and parking scenarios—critical for those with limited mobility or delayed motor reflexes. - One-Handed Operation for Flexibility:

Ideal for drivers managing mild disabilities, rehabilitation from injury, or post-surgical restrictions. Some designs support those who use a cane or walker and still retain driving capability. - Psychological Benefits:

Steering aids restore a sense of control and independence—something many elderly drivers fear losing. This, in turn, leads to longer, safer driving lives.

Use Cases in B2B Markets: Strategic Adoption Across Multiple Channels

The value of steering aids extends well beyond individual consumers. In fact, B2B sectors are among the fastest-growing adopters:

- Fleet Vehicles (Delivery Vans, Taxis, Utility Services):

Aging employees or contracted senior drivers can remain productive longer with the support of ergonomic steering aids, reducing fatigue-related incidents and improving retention. - Elder Transport and Non-Emergency Medical Transport (NEMT):

Companies and municipalities offering shuttle services for the elderly are retrofitting vehicles with adaptive tools to comply with safety regulations and accessibility standards. - Automotive Aftermarket Targeting Eldercare Segments:

Distributors and retailers—especially online platforms and specialty stores—are increasing inventory of steering aids as part of senior-oriented mobility packages. - Insurance-Funded Retrofit Programs:

In some EU countries and Japan, insurance providers and aging-in-place grants include reimbursements for steering aid installation as part of home and mobility modification programs.

The growing awareness around elder mobility is transforming steering aids from optional accessories into essential tools in the B2B automotive space. Forward-thinking suppliers, fleet operators, and healthcare transport firms are now integrating these solutions as standard offerings—not only to meet regulatory expectations but to future-proof their services in an aging economy.

B2B Trend Analysis: Steering Aid Demand

Procurement Patterns: Inclusive Design as a Purchasing Priority

In today’s B2B procurement environment, the demand for inclusive design and adaptive vehicle components has moved from the periphery to the mainstream. A growing number of organizations—particularly those in logistics, healthcare transportation, and eldercare services—are proactively sourcing steering aids to meet the needs of aging drivers and passengers.

Several key procurement trends are driving this shift:

- Eldercare Service Providers:

Assisted-living transportation companies and home care agencies are increasingly retrofitting their vehicles with spinner knobs to accommodate elderly clients or aging drivers. - Insurance Fleet Managers:

As aging policyholders remain behind the wheel longer, insurers are recommending or subsidizing the installation of ergonomic driving aids to mitigate claims related to joint strain and handling errors. - Mobility Tech Startups:

Companies innovating in the “aging-in-place” and “independent mobility” sectors are sourcing steering aids in small batches for product pilots and assistive driving kits. - Procurement Teams Focused on ESG and Accessibility:

With a growing emphasis on Environmental, Social, and Governance (ESG) goals, some procurement officers now treat vehicle inclusivity as a measurable social impact metric—boosting demand for ergonomically friendly parts.

These procurement decisions reflect a broader shift: steering aids are no longer just an aftermarket convenience; they are fast becoming a core B2B product line with clear end-user impact.

OEM & Aftermarket Opportunity: A Path to Brand Differentiation

The demographic imperative is creating lucrative opportunities across both OEM and aftermarket channels:

- OEM Tiered Offerings:

Automotive brands are exploring tiered options for “mobility assist packages” targeted at senior buyers, especially in minivans, sedans, and compact SUVs. Including a branded, factory-installed steering knob positions manufacturers as forward-thinking and accessible. - Aftermarket Customization:

Specialty retailers and auto accessory brands are developing eldercare-themed SKU bundles—combining steering knobs with other assistive items like mirror extenders, pedal lifts, and seat swivel bases. - Brand Positioning:

Manufacturers like Okjaws that offer precision-engineered, zinc alloy-based steering knobs with smooth bearing systems and ergonomic designs are well-positioned to lead this category. The emphasis on quality, safety certifications, and durability gives suppliers a unique advantage in markets where compliance and brand trust are crucial. - B2B Sales Enablement:

Offering product training, user manuals tailored to elderly customers, and installation videos has become a key differentiator for steering aid brands trying to win distributor and fleet business.

In short, steering aids are evolving into a value-added product segment that supports not just driver comfort but strategic brand messaging around inclusivity, safety, and innovation.

Case Study Spotlight: Doubling Demand in Taiwan’s Aging Corridor

A compelling example of market acceleration comes from central Taiwan, where a regional distributor serving the eldercare and healthcare fleet segment reported a 108% year-over-year growth in steering wheel knob sales between 2022 and 2024.

Several key factors contributed to this trend:

- A surge in contracts with senior mobility services and local government elderly outreach programs.

- Increased awareness among caregivers and driving instructors about the benefits of steering aids for elderly and post-operative drivers.

- Strategic partnerships with vehicle retrofit centers specializing in accessible transport.

This case is not isolated. Similar sales trajectories have been noted in parts of Japan, southern Germany, and the U.S. Sunbelt states, where senior population density and vehicle dependency intersect.

The data is clear: steering aid demand is growing—not only due to population aging but because B2B buyers are aligning their procurement strategies with inclusive design principles. For manufacturers, OEMs, and suppliers, now is the time to elevate steering aids from optional accessories to strategic product lines ready to meet the needs of tomorrow’s drivers.

Market Forecast and Sizing

Growth Trajectory of Mobility Assist Products

The global market for mobility assist devices—particularly those adapted for vehicle use—is poised for robust growth in the coming decade. According to data aggregated from Statista and IBISWorld, the global assistive mobility device market (which includes steering aids, pedal extenders, and ergonomic seating solutions) was valued at approximately USD 9.2 billion in 2022 and is projected to reach USD 15.6 billion by 2030, registering a compound annual growth rate (CAGR) of 6.8%.

A key growth driver is the increase in elderly individuals retaining personal mobility via private vehicles. This is especially relevant in suburban and rural regions, where aging residents rely on cars to maintain independence in the absence of robust public transit.

When isolating the steering aid segment, the global market was estimated at USD 570 million in 2024, with projected growth to USD 1.04 billion by 2030, representing a CAGR of 9.9%. This segment includes both OEM-integrated devices and aftermarket products such as spinner knobs, steering stabilizers, and ergonomic wheel grips.

Projected Demand for Steering Aids (2025–2030)

The following table summarizes the expected trajectory of global demand for steering aids based on primary market research and secondary data from industry analysts:

|

Year |

Estimated Global Market Value (USD) |

Year-over-Year Growth (%) |

|

2025 |

$620 million |

+8.8% |

|

2026 |

$685 million |

+10.4% |

|

2027 |

$756 million |

+10.4% |

|

2028 |

$835 million |

+10.5% |

|

2029 |

$920 million |

+10.2% |

|

2030 |

$1.04 billion |

+10.3% |

Source: Statista, IBISWorld, Allied Market Research (estimates aggregated and normalized)

Correlation Between Aging Demographics and Steering Aid Adoption

To further illustrate this growth, the following chart compares the population aged 65+ in key markets with the adoption rate of steering aids as reported by fleet distributors, mobility equipment suppliers, and eldercare transport firms.

|

Region |

% Population Aged 65+ (2030) |

Steering Aid Adoption Rate (Est. % of Elder Drivers) |

|

Japan |

35% |

58% |

|

Germany |

28% |

42% |

|

United States |

22% |

39% |

|

South Korea |

25% |

45% |

|

Taiwan |

26% |

47% |

Key Insight: In countries where elderly drivers comprise more than one-fifth of the population, steering aid adoption rates are approaching or exceeding 40%—with steeper adoption curves expected as awareness campaigns and insurance reimbursement programs gain traction.

Strategic Interpretation for B2B Buyers

- Distributors: Prepare to expand SKUs and ramp inventory planning for high-turnover spinner knobs and universal-fit steering aids.

- OEMs: Consider built-in or add-on ergonomic steering devices as standard features in trim levels targeting retirees and elder-friendly models.

- Fleet & Mobility Providers: Budget for annual steering aid upgrades and offer assistive hardware as part of service packages.

As global aging accelerates and inclusive design becomes a procurement mandate, steering aids are projected to be one of the fastest-growing product categories in the mobility assist segment—offering tangible returns for those who invest early in this transformation.

Regional Insights: Aging Drivers and Steering Aid Demand by Geography

As the global population ages, regional variations in policy, infrastructure, and cultural attitudes toward aging and mobility are shaping how—and how quickly—steering aid demand accelerates. Here’s a breakdown of the most influential regional markets:

Japan: Aging at Warp Speed, Leading Steering Aid Adoption

Japan continues to be the world’s most aged society, with nearly 30% of its population over 65, a number expected to climb to 35.3% by 2040 (UN Population Division, 2023). This demographic profile is transforming the automotive landscape:

- Elder drivers are highly independent, and many continue driving into their late 70s and 80s, particularly in rural areas.

- Japan has the world’s highest per capita adoption rate of vehicle assistance tools such as spinner knobs, mirror extenders, and pedal modifications.

- Prefectural governments and senior mobility programs actively subsidize assistive driving hardware, often partnering with car accessory suppliers for mass installations.

B2B Insight: Local distributors and automotive retrofitters are experiencing stable, year-over-year growth in steering aid orders—particularly through nursing home fleets and elder shuttle operators.

EU & North America: Policy Support Meets Strong Senior Driving Culture

European Union:

The EU, especially countries like Germany, France, and Italy, faces similar aging demographics with 22–25% of the population aged 65+ by 2030. However, the EU’s influence comes from regulatory leadership and funding support:

- Adaptive driving aids are increasingly considered part of inclusive mobility design under European Commission recommendations.

- Fleet operators in eldercare, public health, and delivery sectors are encouraged—sometimes required—to offer ergonomic modifications.

- Elder driver evaluations often include recommendations for assistive tech, boosting aftermarket demand.

United States:

In the U.S., the number of drivers aged 70 and older surpassed 31 million in 2022, with projections indicating nearly 40 million by 2030. Key trends include:

- Strong senior preference for personal vehicle use, especially in suburban and retirement communities.

- A booming market for aftermarket steering aids, largely through e-commerce platforms and adaptive equipment dealers.

- Auto insurers increasingly recommend or reimburse for spinner knobs as part of senior driver safety enhancement programs.

B2B Insight: OEMs in the U.S. are exploring trim packages tailored for retirees, while aftermarket retailers report increasing demand through Amazon, Walmart, and direct B2B portals.

Emerging Asia (Taiwan & South Korea): Market Entry Phase with Strategic B2B Positioning

While Taiwan and South Korea historically had younger demographics, they are now among the fastest aging nations globally:

- South Korea is projected to become a “super-aged society” by 2025, with over 20% of its population aged 65+.

- Taiwan crossed the 16% aging threshold in 2021, entering what the UN defines as an “aged society.”

Unlike Japan or the U.S., these markets are just entering the early acceleration phase of elder mobility adaptation. However, B2B movements are rapidly emerging:

- Taiwanese automotive distributors are working with local manufacturers to develop and market “senior driving packages,” including branded steering aids.

- South Korean conglomerates in the auto aftermarket space are beginning to pilot eldercare-focused product lines, often as part of CSR and ESG initiatives.

- Government grants and public health agencies are initiating vehicle assistive tech evaluations, opening the door for formal certification and B2B scale-ups.

B2B Insight: Now is the optimal window for B2B players to position themselves as first-movers—establishing supply chains, distribution agreements, and local partnerships before the demand curve steepens.

Conclusion of Regional Insights:

From mature markets like Japan to high-potential accelerators like South Korea, steering aids are being recognized as essential tools for safe, independent aging. B2B buyers who understand these geographic nuances will be best positioned to deliver timely solutions—and capture share in a rapidly evolving category.

The Role of Manufacturers like OKJAWS

In the fast-growing market for steering aids, success depends not just on product innovation, but on manufacturing partners with deep expertise, proven reliability, and the flexibility to meet both high-volume OEM demands and niche-market customization. Okjaws Co., Ltd., a Taiwan-based steering wheel knob specialist, exemplifies this ideal.

Over 40 Years of Engineering Excellence

Founded in 1976, Okjaws has spent more than four decades perfecting the design and production of steering wheel knobs. As a dedicated spinner knob manufacturer, Okjaws is recognized globally for its precision craftsmanship, consistent quality, and user-centered engineering.

Their deep-rooted manufacturing experience allows them to respond quickly to changing market demands—particularly those emerging from the aging population segment. This longevity also translates into a production ecosystem that balances traditional workmanship with modern, scalable efficiency.

R&D-Driven Ergonomic Innovation

Okjaws invests heavily in in-house research and development, with a focus on ergonomic performance, safety, and long-term durability—attributes that are critical for elderly drivers and B2B buyers seeking dependable solutions.

Key product design elements include:

- Zinc alloy die-casting for structural integrity and a premium tactile feel.

- Precision bearing mechanisms that ensure smooth, quiet, and effortless steering—reducing wrist and shoulder fatigue.

- Secure screw-fastened mounts that prevent slippage or wobbling over time, even in fleet vehicles subjected to daily use.

These features are engineered not only for comfort but also for compliance with global safety expectations in both the consumer and professional transport sectors.

OEM Partnership and Niche Production Capabilities

In addition to serving global distributors and fleet suppliers, Okjaws is a trusted OEM partner for automotive brands and aftermarket system integrators. Their production infrastructure supports:

- High-volume OEM integration for branded vehicle lines or mobility packages.

- Low-to-medium batch customization—including custom logo printing or region-specific adaptations—ideal for eldercare fleets, government transportation tenders, and B2B resellers targeting aging drivers.

Okjaws has built a reputation among B2B clients for reliability, responsive customer service, and an unwavering commitment to detail—traits that are increasingly rare in a cost-pressured manufacturing landscape.

Takeaway for B2B Buyers:

Partnering with Okjaws means more than acquiring a product—it means gaining access to a supply chain of quality, innovation, and flexibility. Whether you’re sourcing for national distribution or building a localized, elder-friendly vehicle fleet, Okjaws stands out as a category leader in steering aid manufacturing.

Challenges and Considerations

As the demand for steering aids accelerates globally, stakeholders must carefully navigate key challenges that can impact product safety, brand reputation, and long-term market success. For B2B buyers, OEMs, and distributors, understanding these risk areas is crucial to ensuring customer satisfaction and regulatory compliance.

Safety and Compliance: Navigating Global Regulations

Steering aids directly affect driver control, making regulatory compliance and product safety paramount. In many countries, steering accessories must meet safety standards set by national or international authorities. Key frameworks include:

- FMVSS (Federal Motor Vehicle Safety Standards, U.S.)

While FMVSS does not directly certify aftermarket steering aids, products must not interfere with steering systems, airbag deployment, or essential vehicle functions. Distributors serving U.S. markets must ensure product compatibility and non-obstruction to OEM safety features. - ECE Regulation (Europe)

Under UNECE regulations, aftermarket accessories must not impede Type Approval safety functions. Steering knobs must be removable or rotatable and must not obstruct the driver’s grip in an emergency. - Japan & Korea Standards

Local standards such as JIS and KATRI also define structural and performance expectations for steering devices used in retrofitted mobility vehicles.

B2B Tip: Partner only with manufacturers who provide test documentation and certifications such as CE marking, ISO 9002 compliance, and product-specific QA reports.

User Training and Installation: Essential for Elderly Safety

Improper installation of steering aids can lead to reduced control, steering lock, or slippage, especially dangerous for elderly users who may already have reduced reaction times or strength.

- Correct Mounting Is Non-Negotiable

Devices should be securely clamped or screwed, with alignment instructions that account for left- and right-handed drivers. Poorly installed knobs can loosen over time, creating serious safety risks. - Need for Training Materials and Support

B2B buyers should prioritize products accompanied by:- Clear multilingual manuals

- Installation videos or QR-code linked tutorials

- Visual diagrams for hand positioning

- Dealer and Fleet Training

For fleets and institutional buyers, bulk installation training or on-site setup support can reduce misuse and warranty claims. Retailers should also train sales reps to recommend the correct knob type based on driver strength and vehicle design.

Market Saturation & Differentiation: Standing Out in a Crowded Field

As the steering aid category gains traction, the aftermarket space has seen a surge in low-cost imports and copycat products—many of which fail quality benchmarks or lack certification.

- Risk of Brand Dilution and Customer Distrust

Visually similar but technically inferior products can confuse buyers and erode category confidence if safety issues arise. - Overcoming “Cheap Knockoff” Perceptions

To maintain consumer trust and B2B credibility, leading suppliers must:- Emphasize material quality (e.g., zinc alloy vs. plastic)

- Highlight bearing system technology

- Display certification badges and origin details on packaging and listings

- Value Through Differentiation

Brands like Okjaws differentiate through:- Rigorous QA

- Longstanding OEM relationships

- A reputation for zero-defect tolerance and customer responsiveness

B2B Recommendation: Avoid commoditizing steering aids. Instead, sell them as premium safety tools, not generic car gadgets—backed by training, warranties, and professional-grade documentation.

Summary:

As the category matures, success will come not only from meeting demand but from meeting it safely, consistently, and distinctively. Steering aids may be small in size, but in the hands of aging drivers, their impact is immense—so B2B buyers must prioritize compliance, education, and brand integrity at every step.

Future Outlook: The Evolution of Steering Aids in a Smart Mobility Era

As the automotive industry embraces digital transformation, steering aids are on the verge of a technological leap forward. No longer limited to passive mechanical tools, future products are expected to integrate seamlessly with smart vehicles, advanced driver assistance systems (ADAS), and personalized mobility platforms. For B2B buyers, OEM innovators, and adaptive mobility solution providers, this evolution presents new opportunities for differentiation, safety, and value-added services.

Integration with Smart Vehicles and ADAS

With the rise of connected cars and semi-autonomous vehicles, steering aids are poised to become part of the broader driver assistance ecosystem. Features under exploration or early-stage deployment include:

- Sensor-integrated knobs that interface with vehicle telemetry, detecting driver fatigue or erratic movement.

- Bluetooth-connected aids that relay grip pressure or turning frequency to vehicle systems for real-time risk monitoring.

- Compatibility with lane assist and parking assist features, allowing drivers to regain control through physical input while maintaining system support.

OEM Opportunity: By co-designing steering aids with embedded electronics, automakers can offer adaptive control solutions tailored to senior or rehabilitating drivers—combining ergonomic utility with digital safety.

Haptic Feedback and AI-Assisted Steering Devices

A new frontier in assistive driving involves intelligent feedback mechanisms that alert or guide users based on real-time driving conditions. Within the next 5–7 years, we may see:

- Haptic-enabled spinner knobs that provide vibration alerts when veering off-lane, approaching a turn too sharply, or speeding in tight spaces.

- AI-assisted control modifiers that adjust the resistance or ease of spin based on driving behavior, weather conditions, or road surface—especially beneficial for elderly users with slower reflexes.

- Adaptive learning systems that track a driver’s steering patterns over time and make micro-adjustments to reduce strain and improve responsiveness.

These innovations can transform steering aids from static hardware into intelligent driver support systems, bridging the gap between analog control and digital oversight.

Cross-Sector Demand: A Broader Wellness Mobility Ecosystem

The next phase of growth for steering aids will extend beyond automotive retail and into healthcare, rehabilitation, and insurance-driven mobility solutions.

- Rehabilitation Centers: Therapists are incorporating car simulators with spinner knobs into driver re-training for stroke, orthopedic surgery, or trauma recovery patients.

- Insurance Providers: As part of preventative accident-reduction programs, insurers in markets like Germany and South Korea are considering subsidies for certified ergonomic steering tools for senior policyholders.

- Wellness Tech Integration: Steering aids may eventually connect with wearables and biometric trackers to create personalized driving experiences. For instance, adjusting grip sensitivity when muscle fatigue is detected through a smartwatch.

B2B Insight: These intersections unlock new sales channels for suppliers who can co-brand with wellness platforms, hospital systems, or insurance networks—positioning steering aids as part of a proactive aging and safety lifestyle.

In Summary:

The future of steering aids is smart, data-informed, and integrated. For B2B stakeholders, the challenge is no longer simply offering a functional product—it’s building a forward-compatible solution that supports the next generation of adaptive driving. Those who embrace this shift will not only serve aging drivers more effectively, but also play a vital role in shaping the inclusive mobility ecosystems of tomorrow.

Conclusion

The demographic wave of aging drivers is not a short-term shift—it is a long-term structural trend that will redefine how vehicles are designed, sold, and equipped for decades to come. As life expectancy increases and seniors remain active and independent longer, their expectations for comfortable, safe, and user-friendly driving solutions are transforming product demand across global automotive markets.

Among the most impactful responses to this shift are steering aids—simple yet powerful tools that enhance control, reduce strain, and preserve mobility for aging drivers. From spinner knobs and ergonomic wheel handles to smart, connected steering systems, these products are now central to discussions around adaptive mobility and inclusive design.

For B2B buyers, distributors, OEMs, and mobility innovators, steering aids represent both a commercial opportunity and a social responsibility. The demand is growing, the use cases are multiplying, and the market is becoming more sophisticated. Those who respond with quality, compliance, and innovation will be best positioned to lead.

✅ Call to Action:

Now is the time for distributors, e-commerce sellers, and OEM buyers to future-proof their catalogs with smart steering aids built for a demographic shift that’s already here.

Whether you’re sourcing for fleet upgrades, developing elder-targeted vehicle packages, or enhancing your online storefront with mobility-friendly tools, steering aids offer a scalable, high-impact solution for the road ahead.